by Christian Usera

ANN ARBOR’S PERFORMANCE Network Theatre has been in financial trouble for years, but its most recent financial difficulties might be just the tip of a titanic iceberg. The group has filed income tax returns (in 2011) for the fiscal year ending September 2010. According to the IRS Charitable Division, failure to file 990 tax returns for three years consecutively results in automatic loss of tax exempt status. The Michigan Attorney General’s office says officials there have been in touch with PNT in an effort to bring the group back into compliance with state laws regarding the legal solicitation of donations. Since 2011, PNT has not been licensed by the state to legally solicit donations.

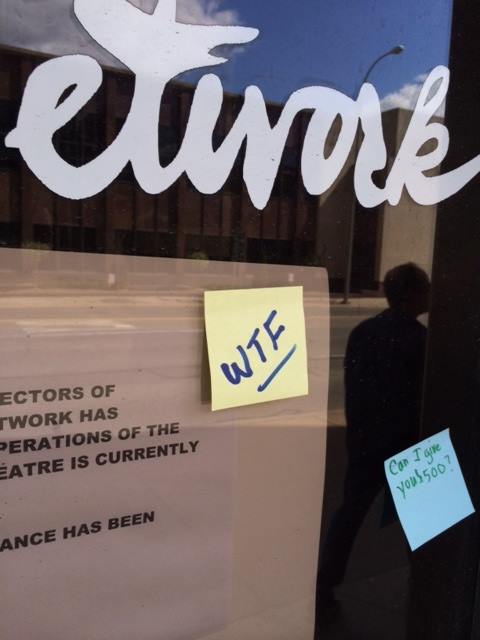

While the embarrassing mess moulders—and interest accrues—members of the group’s Board of Directors refused to comment or claimed not to remember anything. PNT removed a link from its website to a page that listed the names of the Board members.

In June 2014 the Performance Network Theatre’s Board of Directors reviewed two competing bids to restructure the organization and the debt accrued by the organization. The accepted proposal was written by the current director John Manfredi and Suzi Regan, the Theatre’s artistic director. The proposal attempts to tackle the organization’s $400,000 debt. Manfredi and Regan assert, “This debt and poor accountability from previous management resulted in a suspension of (the Theatre’s) activities… in May of 2014.”

However, the previous Executive Director Carla Milarch disagrees. She asserts a combination of events led to PNT’s financial troubles, including balloon payments on the Theatre’s mortgage, a lack of performance from the Development Director in charge of grants, and the recent economic recession.

In reality, there were many financial and managerial slip-ups by both staff and the nonprofits’s board members which led the Theatre to shut its doors, leaving ticket holders in the lurch. First and foremost was the debt accrued by the nonprofit during the tax years between 2008-2010. These financial troubles meant the Certified Public Accountant (CPA) went unpaid. Income tax returns for the fiscal years 2011-2013 have not been filed.

According to the Michigan Attorney General’s Office, a nonprofit company must provide a “Renewal Solicitation Registration” along with pertinent tax and financial documentation in order to keep its “Right to Solicit” license. Since Performance Network Theatre didn’t file 990 income tax returns, it could not deliver the proper paperwork and financial data. Thus, according to the AG’s office, the Theatre lost its “Right to Solicit” license in 2011, a binding agreement with the state that grants a nonprofit the legal right to solicit and accept donations within Michigan.

According to PNT officials and the IRS, the organization filed its taxes through 2011. According to the Michigan Attorney General’s office, PNT currently does not have a verifiable “Right to Solicit” licensure. All of this begs the question of how Performance Network Theatre is currently accepting and soliciting donations when its licensure to do so has lapsed? The Theatre’s most recent fundraiser was held between Aug 15-19 of this year.

Are local donors and those purchasing tickets sinply throwing good money after bad?

According to Joy Yearout, the Director of Communications at the Attorney General’s Office, the penalty per violation of the Charitable Organizations and Solicitations Act can be up to $10,000. However, Yearout stated, “The Attorney General’s Charitable Trust Section tries to get organizations into compliance with registration requirements rather than proceeding immediately to punitive actions. When we become aware of a possible violation, we would first try to work with the charity to develop an action plan to come into compliance. This can vary based on the charity’s circumstances. “ Yearout went on to say, “On April 4, 2014 our office sent the organization a notice that their registration had expired and requested updated information. We have not yet received a response. They should expect a follow-up inquiry from us soon, because if they are indeed engaged in charitable solicitation without the required registration, they may be violating Michigan law. However, without all the facts, I cannot address whether this organization is in violation. That’s why we’ll be reaching out to them to get more information.”

Given that Performance Network Theatre has failed to verify that its licensure lapsed, one cannot know the current state of the renewal process or what (if any) penalty the organization might incur. The Ann Arbor Independent made several attempts to receive comment from both the President of the Board, Ron Maurer and the Treasurer of the Board, Tom DeZure, but did not receive a response.

Mauer is Vice President of Administration, Zingerman’s Service Network. He holds BS and MBA degrees in finance and accounting and, according to his bio on the ZingTrain website, “regularly teaches a number of internal finance classes for Zingerman’s staff and speaks frequently to outside organizations about Zingerman’s financial systems.”

In order to fully comprehend Performance Network Theatre’s financial troubles, one has to begin with its 2008 tax forms. During that year, PNT was going through a time in which it was fundraising for emergency capital to stay solvent and keep the doors open. The Theatre’s tax records indicate that because the organization scaled back productions, expenditures, staff and shows, it had a modest gain of $37,879. Yet, in 2009 the Theatre ramped up production, added staff and a seventh show to the Theatre’s season. Tax returns indicate a $186,867 loss.

Why did both management and PNT’s Board of Directors add these expenses when the non-profit was barely in the black? Even if one were to take into account the loss of income due to the onset of the Great Recession, the additional expenses still would add up to over $90,000 in losses. The tax return for the next year (2010) is much the same: over $124,000 of losses, while expenditures increased by over $41,000.

Manfredi’s “Business Action Plan” claims that “(the Theatre) will eliminate all but the governmental debt in 36 months and all debt in 60 months, while continuing to operate fully.” The Manfredi/Regan plan projects the Theatre will earn 70 percent of its income through ticket sales, while the remaining 30 percent will be obtained by “(Building) an endowment to consistently generate the remaining (funds).”

It’s unclear why Manfredi did not know the Theatre’s licensure to solicit had expired three years earlier. Such records are readily available online through the Michigan Attorney General’s website. The AG’s office responded within 48 hours to an email from The Ann Arbor Independent with a status report concerning PNT’s last filed tax return as well as the status of the group’s license to solicit donations (expired in 2011). A phone call to the AG’s Charitable Organizations division confirmed the information contained in the email and that organization’s out of compliance which solicit donations are subject to prosecution, penalties and fines.

When questioned, Manfredi replied, “The Theatre has never lost its nonprofit status and we are working with every government agency, both state and federal to remedy any outstanding debt or applicable paperwork which needs to be filed.”

The Performance Network Theatre has been bedeviled by financial issues going back for at least six years and officials refused to say when the missing years’ tax returns would be filed with the IRS. Until that happens, the public cannot gain a full understanding of why the Theatre went dark. When pressed as to when these financial records would be made available Manfredi answered, “That’s confidential.”

Given the large debts owed to third parties (not to mention the IRS), the secrecy of staff concerning financial reporting and the lack of licensure to solicit donations, can the public trust that the Theatre won’t go dark a second time?