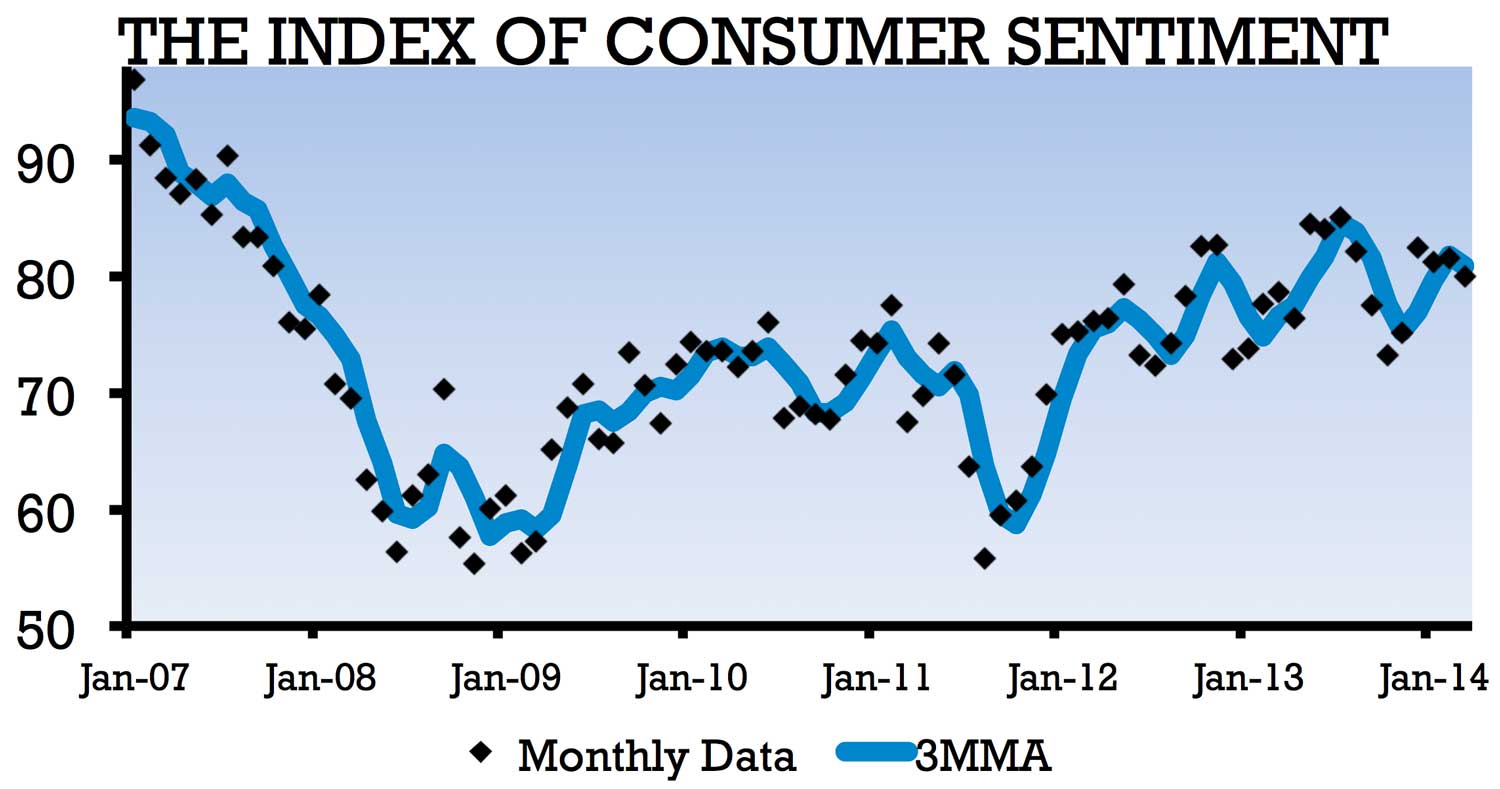

Consumer Confidence Levels in March Unchanged From December 2013 Levels

CONSUMER CONFIDENCE has remained largely unchanged in the past three months despite the hard winter, as well as a severe drought.

Consumer finances were just as strong in March as in December 2013, and more importantly, consumers viewed their financial prospects for the year ahead much more favorably in March than at the start of the winter season, according to the Thomson Reuters/University of Michigan Surveys of Consumers. Conducted by the U-M Institute for Social Research since 1946, the surveys monitor consumer attitudes and expectations.

The gains in personal finances were offset by rising concerns about the outlook for the overall economy, according to U-M economist Richard Curtin, director of the surveys.

Consumers have finally begun to expect sustained gains in their personal finances, especially among younger households.

While consumers indicated that they still anticipate the national economy will continue to grow during the year ahead, they have become increasingly concerned about the ability of the economy to avoid a downturn sometime in the next five years. Of more immediate concern, consumers have voiced their dismay about the slowdown in home value gains, a slowdown that was expected to continue in the year ahead.

“Consumers have finally begun to expect sustained gains in their personal finances, especially among younger households,” said Curtin. “Consumers are ready to celebrate a delayed spring with renewed spending. Since consumers have become accustomed to very low interest rates on loans, even small increases, which simply tempered demand in the past, could now have a much more pronounced impact on sales of homes and vehicles.

“Consumers are more likely to postpone than to speed up purchases in advance of expected increases in interest rates. The Fed now has a more powerful policy tool as well as a less forgiving tool to a policy misstep.

Personal Finances Improve for Young

When asked about prospects for their own finances, one in three consumers reported in March that they expected their financial situation to improve in the year ahead. The last time a higher share of households anticipated improving finances was nearly five years ago, in June 2009. The gain was concentrated among those under age 45, as 54 percent expected improved finances in each of the last two months, the highest levels since 2007.

Buying Plans Slip

Home and vehicle purchase plans declined in March due to less frequent references to low and discounted interest rates on these purchases. The data suggest that people have changed how they evaluate interest rates on loans following the prolonged period of low interest rates (and inflation rates). Consumer spending is likely to respond much more strongly to what would have been considered a minor increase in interest rates in the past.

The Sentiment Index was 80.0 in the March 2014 survey, insignificantly below February’s 81.6 or January’s 81.2, and just above last March’s 78.6. Compared with a month ago, the Current Conditions Index remained largely unchanged (+0.3 percent) while the Index of Consumer Expectations fell (-3.7 percent). The decline in the Expectations Index was mainly due to less favorable prospects for the overall economy.