Ann Arbor Short-Term Rental Owners Could Be Subject to Higher Taxes if Bills Pass State Legislature

by Jaime A. Hope

Proposed legislation targets owners who rent property for more than 14 days per year

Owners of short-term rentals may have to deal with more regulations and additional taxes under a new package of bills introduced in the Legislature. Ann Arbor State Rep. Jason Morgan, along with 21 co-sponsors, introduced the bills.

House bills 5437–5446 aim to create the Short-Term Rental Regulation Act, which would subject certain short-term rental owners to new regulations. The regulations would apply to property rented for more than 14 days in a calendar year. Existing local ordinances would remain.

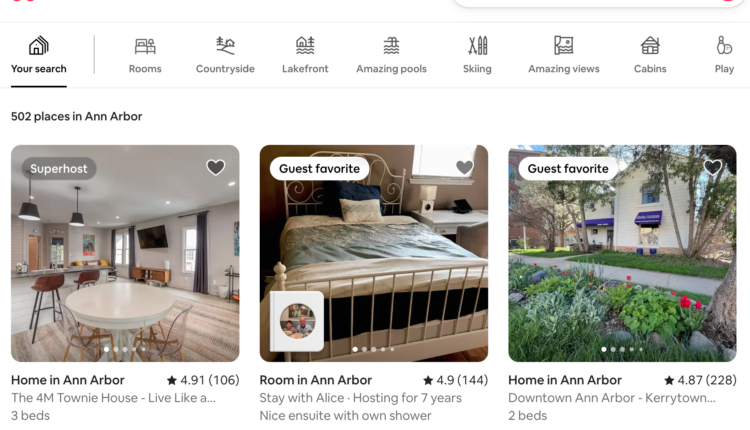

The bills would also apply to hosting platforms such as Airbnb and VRBO, which would have to pay an annual registration fee equal to $100 per listing, not to exceed $50,000 per year.

State Rep. Joey Andrews, D-St. Joseph, said the bills seek to allow local government to regulate short-term rentals.

“In communities all over Michigan — especially, but not exclusively, communities such as those I represent along the lakeshore — STRs are creating regulatory headaches at best and serious safety concerns at worst,” Andrews said. “It’s long past time we put some reasonable guardrails in place to allow local governments to address STRs, respect the needs of permanent residents and bolster our tourism economy.”

The bills would impose registration requirements, safety regulations, and obligations to file paperwork with the state treasury department.

Mark Florian is a trustee of Berrien County’s Lincoln Charter Township and a short-term rental owner. He opposed the plan at an April 17 committee hearing.

“We have an ordinance that regulates short-term rentals,” Florian said. “If we need another law or package of laws to enshrine a law or power that already exists then maybe we need to take a step back and remove the ambiguities within the current laws.”

Short-term rental owners already pay a 6% use tax on rental income. If the bills pass the House and Senate and are signed into law, short-term rental owners renting more than 14 days per calendar year will have to pay an additional 6% accommodations tax, which hotels and motels pay.

Short-term rentals would also be subject to an additional 5% excise tax not imposed on hotels and motels.

For example, the owner who charges $1,000 for rental property, would have to pay $60 in use tax, a $60 accommodations tax, and a $50 excise tax. That is $170 or 17% of the property owner’s earnings.

The nonpartisan House Fiscal Agency estimated, using limited data on the short-term rental market, that the 6% excise tax in House Bill 5438 could generate between $35 million to $70 million annually.

The plan proposes civil fines of $1,000 for short-term rental owners who violate the act or a $5,000 fine for hosting platforms.

Under the plan, rental owners must insure each rental unit with a minimum of $1 million in liability insurance.

HB 4537 was referred to the Committee on Labor.

Comments are closed, but trackbacks and pingbacks are open.