Michigan Dems Next Moves: $180 “Inflation Relief” Checks, Raising EITC, Scrapping Retirement Tax

by Anna Gustafson, Michigan Advance

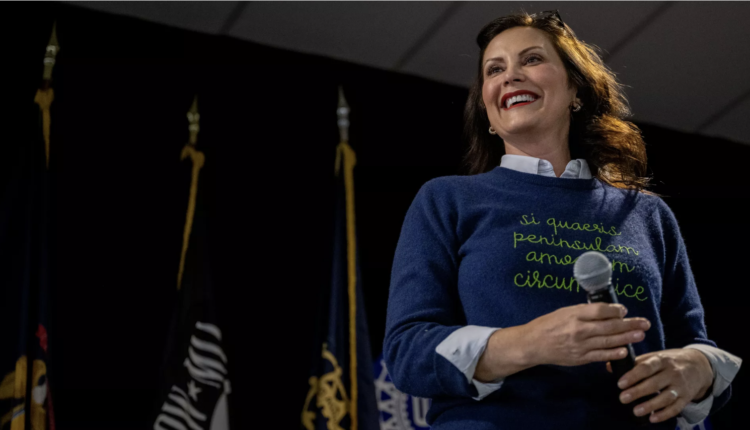

After weeks of negotiations, Gov. Gretchen Whitmer and Democratic legislative leaders announced Monday morning that Michigan taxpayers would receive $180 “inflation relief” checks as part of a proposal that includes boosting the Earned Income Tax Credit (EITC) and rolling back the state’s so-called retirement tax.

“I’m excited about delivering the largest tax break in decades to the people of Michigan,” Whitmer said at the press conference held at the Romney Building in downtown Lansing.

State Senate Majority Leader Winnie Brinks (D-Grand Rapids) and House Speaker Joe Tate (D-Detroit) joined the governor to detail the tax relief package, which Democrats have named the “Lowering MI Costs” plan.

Lawmakers in the Democratic-controlled House and Senate will need to approve the pending tax relief legislation package that includes about $800 million for the one-time $180 checks that would go out for each income tax filing. (That means couples filing jointly would receive one check for $180 and not two for $360.) If lawmakers pass the legislation, the checks could be issued as soon as this spring.

The $800 million will come from General Fund revenue. Michigan currently has an approximately $9.2 billion budget surplus, including a $5.1 billion surplus in the General Fund and a $4.1 billion surplus in the School Aid Fund. About $5.8 billion of that is for one-time use.

“Getting this done will help people pay the bills and put food on the table as inflation impacts their monthly budgets,” Whitmer said.

The Democrats’ tax relief proposal includes increasing the EITC — which lawmakers interchangeably call the Working Families Tax Credit — from 6% to 30% of the federal level, retroactive to 2022. This means qualifying Michiganders could claim a credit worth 30% of the federal amount on their taxes.

That increase — which comes after Republican former Gov. Rick Snyder in 2011 cut the EITC from 20% to 6% — is expected to benefit approximately 700,000 Michiganders annually earning about $57,000 or less. Those individuals would see an additional $600 per year from the EITC boost, according to an analysis from the Michigan League for Public Policy.

The governor’s office has said in press releases that the EITC increase translates to annual savings of about $3,150, which reflects federal and state savings; it is not $3,150 in new savings.

“This one for me is personal,” Brinks said of the EITC increase. “Twelve years ago, I was a caseworker at a nonprofit. … I remember when the previous [Snyder] administration stripped away that tax credit, and I remember the pit in my stomach as I sat down with moms and dads every day who were just trying to make ends meet for their families.”

The Democrats’ proposal also phases out the state’s retirement tax over four years — a move that follows Snyder in 2011 signing highly controversial legislation establishing Michigan’s retirement tax that applies a 4.25% income tax on pensions. According to Whitmer’s office, this repeal could save about 500,000 households approximately $1,000 a year.

“This really, I think, strikes the balance of being able to have immediate benefits for people in a real substantive way,” Whitmer said of the entire tax relief package in a phone interview with the Advance following Monday’s press conference. “It helps those that are really struggling with the cost of everything.”

Whitmer, who was the Senate minority leader when Snyder and the Republican-controlled Legislature enacted the tax changes in 2011, said the plan is “an opportunity to make it right.”

“They’ve hurt people, and so I’ve been on a mission to make it right, and I think that the package that we are focused on does that,” Whitmer said in the phone interview. “And so I think I’d love to see robust bipartisan support because I think it merits it and was informed by a lot of the goals that both sides of the aisle have.”

Brinks and Tate emphasized Democrats included feedback from their Republican colleagues in the tax relief package.

“There’s a lot here that Republicans really like,” Brinks said. “It may surprise folks but we do listen to folks on the other side of the aisle when putting together policy.”

Tate added that “there’s no secrets or surprises in terms of what we’re doing right now.”

However, the Democrats’ proposal on Monday elicited criticism from Republican lawmakers.

“The governor is starting to follow Republicans’ lead in calling for immediate, fair relief for the people of Michigan, but she still won’t rule out blocking the automatic income tax rollback for every taxpayer and small business in our state,” House Minority Leader Matt Hall (R-Richland Twp.) said in a prepared statement issued following Monday’s press conference.

Republicans have focused much of their attention on the possibility that Michigan could see an automatic income tax cut due to a 2015 law that ties the income tax, currently 4.25%, to the state’s General Fund. However, some legal experts have said that the Legislature overstepped its authority with that legislation.

Because of the state’s soaring revenue last year, that percentage could drop to 4.05% — something which Republican lawmakers want to see. Should the $800 million for the $180 checks come from the 2022 General Fund, that would likely mean there would not be an automatic income tax cut.

When asked about the income tax cut, Whitmer said the $180 relief check combined with the EITC increase and the pension tax repeal would provide more “meaningful relief.”

“This was the biggest way we can really make a difference in people’s lives,” the governor said.

Comments are closed, but trackbacks and pingbacks are open.