by Scott McClallen

After losing about 5 million riders since 2017, the Ann Arbor Area Transportation Authority is seeking a $21.8 million tax hike over five years on the Aug. 2 primary ballot on property owners in the cities of Ann Arbor and Ypsilanti and Ypsilanti Township.

AAATA is asking voters to approve a 2.38 mill ballot measure. If approved by voters, this proposal would replace the existing 0.7 mill levy, creating an additional net levy of 1.68 mills active in 2024, a 240 percent increase.

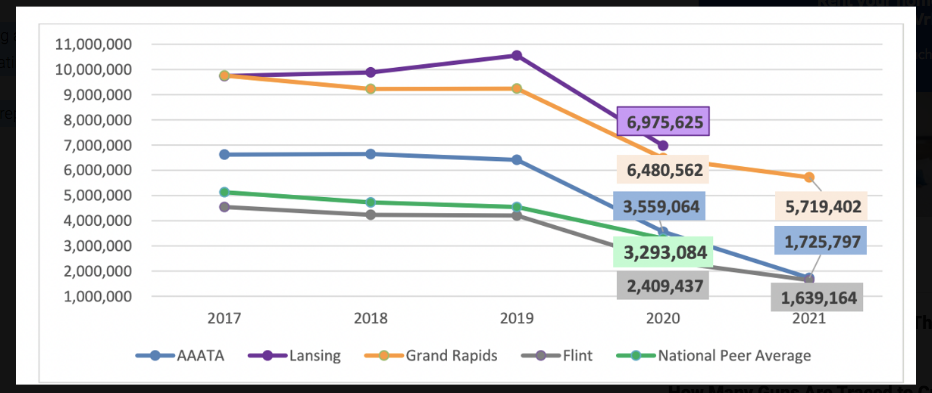

In 2017, AAATA reported ridership of under 7 million, but in 2021 it dropped to 1.7 million.

Dr. Molly Kleinman is a Mayoral appointee to the Ann Arbor Transportation Commission, which she presently chairs. On social media, Kleinman has criticized Ypsilanti Township Supervisor Brenda Stumbo for sending out a mailing to her constituents in which Ypsilanti Township voters are urged to reject the AAATA millage proposal.

This is the mailer sent out to Ypsilanti Township voters. Kleinman’s assertion that voters were encouraged to vote no is false:

AAATA performance reports show that ridership per capita dropped from 16.05 in fiscal year 2020 to 7.78 in 2021.

Meanwhile, the cost per trip increased from $8.50 in 2020 to $17.04 in 2021, which isn’t adjusted for inflation.

Former Ward 4 City Council member Jack Eaton had this to say about the millage ask:

Ann Arbor property taxes currently include a city transit tax (mandated by the City Charter) of approximately 1.9 mills plus a county transit millage of about 0.7 mill. A total of about 2.6 mills.

City of Ypsilanti residents pay a city transit tax of about 0.9 mill plus the 0.7 mill county transit millage for a total of about 1.6 mills. Ypsilanti Township property taxes include only the 0.7 mill transit millage.

If voters approve the proposed increase, Ann Arbor taxes would include 4.28 mills (2.38 + 1.9) for transit. The median house value in Ann Arbor is in excess of $400,000. The taxable value of that is about $200,000. The 4.28 mills applied to that taxable value would result in $856 in taxes for transit. That is about $2.35 per day, seven days per week. Not a huge amount but not insignificant.

Ann Arbor property tax payers will pay more than those in the other two communities both because of the higher city millage and because of the high property values.

AAATA estimates the cost of this 2.38 mill proposal to be the following, based on average taxable home values:

- Ann Arbor: $445 annually, or $37 per month.

- City of Ypsilanti: $164 annually, or $14 per month.

- Ypsilanti Twp: $181 annually, or $15 per month.

AAATA says it would use the tax hike to increase ridership, maintain existing services, add a new route and longer service hours, more frequent weekend routes, and more customer service agents.

Proposed spending is broken down as follows:

- $5.6 million to renew current services.

- $4.8 million to cover a deficit.

- $3.2 million for funding major capital projects.

- $1.28 million for inflation.

- $1.9 million for longer hours

- $940,000 for 9 new hires.

- $930,000 per year for an Ann Arbor to Ypsilanti Express Service Route.

Ann Arbor resident Amir Fleischmann posted this comment on a Facebook discussion of the millage: “The area’s public transit network sorely needs this extra funding. The lack of late night service is terrible for shift workers and encourages drunk driving.”

“This is an ideal moment to upgrade transit services and gain new riders,” AAATA said in its proposal. “Waiting until the next millage cycle (2029-2033) will certainly be too late to help the community post-pandemic. From a timing standpoint, 2022-2024 is a window of opportunity to grow our ridership and be a greater service to people throughout our communities.”

Funding for the existing millage will end in 2024.

Comments are closed, but trackbacks and pingbacks are open.