Ann Arbor SPARK Officials Refuse Request for Public Records That Show Where Millions in Public Money Went

by P.D. Lesko

Ann Arbor SPARK receives the bulk of its funding from governmental sources, including state and federal grants, as well as the Ann Arbor LDFA, a tax-increment financing authority that diverts money from public schools and libraries to provide operating funds for SPARK. In response to a recent Freedom of Information Act (FOIA) request seeking public records that reveal to whom SPARK officials handed over millions in public money using a trio of publicly-funded programs, officials refused to turn over the information. SPARK’s lawyer claimed in a letter the entity is not subject to FOIA.

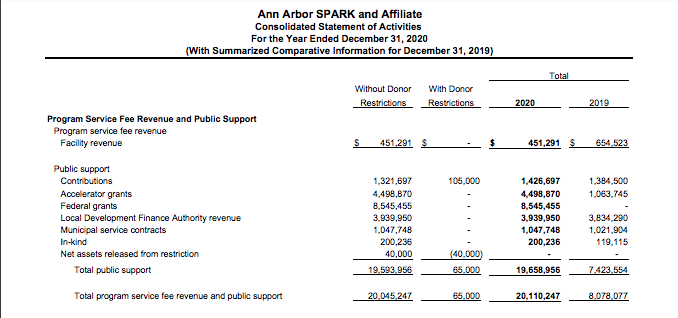

SPARK’s response came from immediate past Board Chair (Honigman attorney) David Parsigian. Parsigian in his letter to the newspaper’s attorney, claimed that SPARK’s public funding comes from “fees for service” work. As such, Parsigian argued, SPARK is exempt from FOIA. However, SPARK’s 2020 audit filed with the IRS contradicts Parsigian’s claim. According to the audit, SPARK took in just $1.047 million in municipal service revenue (fee for services). Conversely, SPARK took in $8.545 million in federal grants, and $4.498 million in Accelerator grants (State of Michigan). The LDFA revenue is a tax-increment capture within the DDA boundary and, according to Ann Arbor officials, funded by the State of Michigan.

Contrary to Parsigian’s assertions, SPARK took in a total of $16.9 million in non-fee for service public funding and $1.047 million in fee for services. Parsigian, as SPARK’s Board Chair in 2020, had the legal duty to review the results of the audit filed in 2020 and conducted by Yeo & Yeo.

In 2021, between the Washtenaw Small Business Emergency Relief Fund, Michigan Small Business Relief Program and Michigan Small Business Survival Grant programs, Ann Arbor SPARK officials claim they distributed millions in public funds to hundreds of businesses. While SPARK officials claim information about the recipients and amounts is not required to be shared with the public, Michigan Economic Development Corporation (MEDC) officials told The Ann Arbor Independent that the information is, indeed, public.

The Michigan Small Business Survival Grant Program distributed approximately $52.5 million to nearly 6,000 small businesses across Michigan. MEDC records show during 2021 SPARK dispersed $4,465,132 in Michigan Small Business Survival grants to 644 businesses in six counties (Hillsdale, Jackson, Lenawee, Livingston, Monroe and Washtenaw), and $350,000 in Michigan Small Business Relief Program funding to Washtenaw County companies. Through the Michigan Small Business Relief Program, a total of 2,879 Michigan small businesses were awarded a total of $20 million in grants and loan. SPARK officials were given $900,000 to distribute under the auspices of the Michigan Small Business Relief Program.

The entire amount of funding given out by SPARK officials from these Michigan programs came from public sources. SPARK’s effort to keep secret how public money was spent is nothing new. It’s an established pattern of flouting Michigan open records laws.

Two years after he was hired by SPARK’s Board in 2011, SPARK CEO Paul Krutko refused requests from elected officials to turn over copies of SPARK’s federal 990 income tax returns, as well as the non-profit’s audit statements. Both are public records, available through a variety of sources, including the IRS, ProPublica and GuideStar.

At the time, former Ward 1 Council member Sumi Kailasapathy, a CPA said, “It’s outrageous. Those people come to City Council for money, and yet they want to keep their financial documents a secret from the public. No, no, no.”

At the same time Kailasapathy asked Krutko for SPARK’s financials, former Ward 2 Council member Jane Lumm also contacted Krutko on behalf of a constituent who had attempted to obtain SPARK’s audits and 990s using the Freedom of Information Act. Krutko never responded to Lumm’s emails.

Krutko was hired to head SPARK after he “abruptly quit” his job in November 2011 as chief development officer of San Jose after “an apparent breach of city policy,” the San Jose Mercury News reported. In 2015, Krutko’s SPARK salary was $298,336, according to federal income tax forms filed by the non-profit. SPARK’s most recent federal 990 income tax form filed in 2020 shows Krutko is paid $572,836. Nonprofits with over $200 million in total expenses report a median pay of $526,679 for their CEOs, according to Charity Navigator. In 2020, SPARK’s total expenses were $7.9 million.

Federal tax forms also show that between 2015 and 2020, SPARK lost a total of $6,526,166 in public money, primarily on money-losing investments in start-ups.

Paul Rudd, SPARK’s current Board Chair, was asked via email to comment on the need for secrecy related to the non-profit’s distribution of public funds. He did not reply.

Comments are closed, but trackbacks and pingbacks are open.