by Christian Usera

THE ANN ARBOR Independent has published two articles regarding Performance Network Theater’s (PNT) beleaguered finances, missing tax filings and the non-profit’s loss of its “Right to Solicit” licensure from the State of Michigan. Now PNT has just finished a month long (12/17/14-1/8/15) IndieGoGo sponsored crowdfunding campaign to raise $30,000. According to the description of the campaign, PNT officials wanted, to quote, “Cover their monthly nut.”

What does this mean?

Well, it means that PNT needs money for “Non-production based operating expenses.” This is about as cryptic as a food label stating an item contains “natural ingredients.”

(Sidenote: Why in the world a nonprofit would name a funding campaign after an Old West term no one has heard of and mix it with a double entendre is beyond me, but I digress.) So why does PNT need the $30,000?

According to PNT’s video on the Indiegogo website, the nonprofit sold tickets to shows for 2015 before it was abruptly closed down last summer. Three-quarters of the money that had been obtained through those sales was already spent before the takeover by new management in July 2014. Thus for every four tickets sold, only one of them is collected as revenue. PNT’s new Exec. Director John Manfredi needs to find a way to bridge the gap of monthly shortfalls. Manfredi, to his credit, is attempting to find ways to add revenue via workshops and lively performances which are excellent (see my review of PNT’s production of “Gift of the Magi”).

However, financial difficulties continue to bedevil the new management, which begs a question: if the organization had such financial difficulties, then why didn’t the Board dissolve the nonprofit and reincorporate with a clean slate? It’s not the quality of performances which appears to be holding back the organization, but rather, a lack of cash flow which laid low PNT even before the new management took over.

Manfredi, of course, is rather sheepish about this fact. When The Ann Arbor Independent asked Sara Dean, the Company Manager, the following questions: (1) What exactly are “Non-production based Operating Expenses?” i.e., what is “The Nut?” (2) Why is PNT specifically seeking $30,000? (3) Does this have anything to do with paying the Certified Public Accountant (CPA)? And (4) Can PNT remain open without the funds? Dean responded with a non-sequitur:

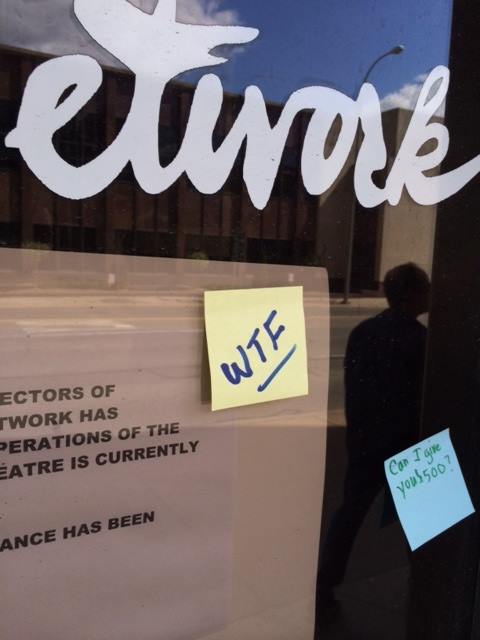

“The Indiegogo campaign ends this Friday, so there’s no need for an article, but thank you for thinking about it though.”

The problem with this answer is two-fold: First, it’s a non-answer and second it completely ignores the fact that those solicited for ticket purchases and donations deserve to know what they’re getting into when they donate. Is a company is on the up and up? Are all required tax filings current? What are the tax ramifications of PNT soliciting donations without solicitation licensure from the state? Does that lack of licensure—only recently corrected by PNT— negate a donor’s ability to write off the donation on state and federal tax returns?

In short, people deserve to know that if they give donations and buy tickets from PNT that they’re not throwing good money after bad.

In addition, although PNT is currently up to date on its “Right to Solicit” licensure registration, according to Sydney Allen, communications representative at the Michigan Attorney General’s office, “When (the theater) renews its solicitation registration this year (2015), (PNT) will again have to provide a copy of its IRS Form 990 for the year that ended on September 30, 2014. Whether separate financial statements are required will depend on the amount of contributions the organization received during that period. “

In essence, although PNT received a waiver for its 2012 missed federal income tax filing, John Manfredi will not receive one when his organization renews its registration this year. The nonprofit theater cannot, as has happened in previous years, fail to file its 2014 federal income taxes and may have to include additional financial documents as required by the AG’s office.

According to emails provided the The Ann Arbor independent by the Michigan Attorney General’s office, John Manfredi requested a waiver for the missing 2012 taxes, because PNT didn’t have sufficient funds to hire a Certified Public Accountant to audit the nonprofit’s finances. Does PNT have the money to hire CPA to help file required 2014 financial documents? The answer is uncertain and not forthcoming from either Manfredi or PNT’s Board President, Ron Mauer, who works for ZingTrain teaching business owners financial accountability.

Thanks to Manfredi’s insistence that PNT’s tax returns are “private” (they are not; they must be made available to the public, according to the Michigan Attorney General’s office) and non-answers to straightforward questions about the nonprofit’s finance, the public is simply not able to ascertain the current financial health of Performance Network Theatre—and that should raise red flags for anyone who’s thinking about donating.

The PNT’s Board has been silent on the subject of the theater’s finances. John Manfredi, the Director of PNT has been dishonest about the company’s loss of its solicitation registration and Sara Dean, the Company Manager, would rather just change the subject.

Because the organization hasn’t filed its 2012 or 2014 taxes, the public cannot know the extent of PNT’s debt, which stands at several hundred thousands dollars at the very least. PNT hasn’t been transparent about its crowdfunding campaign, either.

Although PNT is putting on some very high quality performances, the public deserves to see PNT offer up even higher quality financial accountability and transparency.

The Indegogo campaign raised $1,106, or 3.7 percent of the $30,000 goal. It’s unclear what the money will be used for, ultimately, but perfectly obvious that $1,106 is not nearly enough to cover PNT’s monthly nut.